Do You Follow a BD Process? Do You Really Have One?

We are constantly talking about business development as a process, but the reality is, it is rarely treated that way. Yes, companies work on defining procedures such as criteria for deal selection, steps in the capture phase, procedures for periodic reviews or gates, etc. More often than not, however, these are just operational guidelines for steps to be taken, they do not constitute a process unless they are linked to each other through specific performance criteria. For example, does a potential opportunity have to score a certain number of points associated with your criteria before it can be selected for the pipeline, or do you just talk about them and then take a group think vote when someone asks, “OK, what do you think we should do?” Are there specific steps to complete for each stage in your process; do they have time frames and values associated with them; do your reviews result in scores that can be compared to stage targets such that actual progress is being measured – in other words, is everything connected? Trust me, when its time on the assembly line to put the tires on your car you don’t want to hear someone asking, “What do you think we should do😊”

Let’s follow the automobile analogy further. Think about how this complicated and strangely reliable object is made. First, a significant amount of time is spent on designing every aspect of the vehicle, from its external appearance, internal components down to the seat fabric, to its structural elements, engine components, safety features, electronics, the list goes on. A car manufacturer doesn’t even consider starting assembly until every aspect of the car has been thought out, designed, specifications developed, and manufacturing parameters determined. We could go into more detail, but you get the point. And we are betting you may not give all of this a lot of thought when you go to buy a car, but you do expect a certain consistent result – a car that performs the way the manufacturer says it will, starts every day, stops when you apply the brakes, and lasts for years. Which, when you consider the complexity of the device and the environmental conditions it is subjected to, is impressive.

Now, ask yourself this question, do you apply the same level of rigor and consistency to your BD process? In fact, did you ever define the process, so it is a continuous flow with appropriately connected (yes connected, not just sequential) components? Do you spend the time before every new model is introduced (new business year, new areas of expertise, even just changes in your current expertise as you adopt new methods and integrate new skills) to define all the parameters that create success? Do you have a real plan on how to go to market with these capabilities? What are the implementation details you need to execute to in order to achieve your goals (how many units of the model will you sell, in what price range, what will the geographic demand differences be, do you have the dealer network necessary to respond) and what resources will you need to meet your targets?

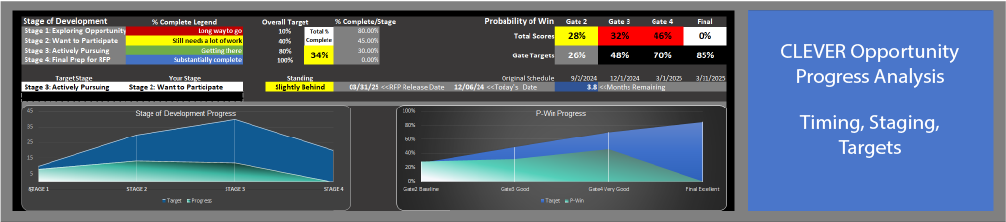

A sample of a progress analysis display in CLEVER, showing the passage of time, expected stage development, measured p-win vs. p-win targets developed by CLEVER based on opportunity attributes.

The fact is, from small to mid-size, to even many large organizations, we do not see the existence of a ‘linked’ end-to-end process that is executed with the rigor required to consistently produce the desired results. But don’t take our word for it, instead, let’s just apply a little logic to a common scenario and see if this substantiates our statement. Let’s assume you used the CLEVER Go-to-Market strategy builder to define what you want to offer by building detailed sematic models of your capabilities, you created a ranked set of targets you want to sell to, you profiled how you will compare/beat your competition, created ranked priorities for your geographic considerations; defined parameters for contract types, solicitation types, socioeconomic classes, and development lead times – then you used your CLEVER Pipeline Modeler to develop a detailed profile of what your pipeline needed to look like, the performance and timing metrics you will need to meet, and the resources it will take to execute. All of this is then used by the CLEVER Smart Selector to evaluate and present opportunities you should pursue based on the theory you are more likely to win them if they fit your strategic criteria and you are more likely to make your financial goals if you execute to your pipeline plan. Based on this you are now sitting on top of a pipeline of carefully chosen pursuits and then – someone calls that you have teamed with before and says, “Did you hear about this deal? We are thinking about going after it, want to join our team?” And you talk about it a little and say “Sure.” Now, is there anything wrong with what you just did?

From the standpoint of the car manufacturer, you just blew up the process. Someone just came along and said, hey, we have a good deal on a new kind of steering mechanism for the car, want to join us and buy some? Do you want to take a guess at some of the negative repercussions to those carefully designed manufacturing plans? In the case of your pipeline:

Work stops on those carefully selected deals while you temporarily switch trains to go in another direction. Yes, you just left the track!

Does this deal fit with the customer base you said you wanted? Did you consider the impact of whether it is a low priority customer, or not on the list at all? Are you diluting the leverage your plan was going to build with that base if the customer does not fit? What other criteria that you developed do not fit?

Is expected progress on one of your high priority opportunities slowed down, resulting in fewer possible bids being made on the prime side of your plan? Meanwhile, you just made an additional bid on the subcontractor side that has less value than what the Modeler planned for, increasing pressure on the rest of the planned opportunities?

Are critical resources side-tracked, maybe for just a couple of weeks, but does that end up costing you an important meeting opportunity on one of your key pursuits only to have the RFP come out and you are not as ready as you could have been? Boom, your P-Win just went down. The plan is out of sync. Your risk of missing target just increased.

Being opportunistic (like the company above) is like eating something someone just handed you without knowing where it came from or how it was cooked, and blue birds are the black plague. Bottom line, when an attack plan is being executed and someone decides to take their unit and wander off for a picnic – bad things happen.

This is why we don’t sell licenses to CLEVER. For one thing, being a complete end-to-end process, it is not simple, and we don’t pretend it is. Second, sometimes an outsider can provide insights that might not come up from your staff – yes, we believe part of our job is to keep the process working the way it is supposed to, and if that is a little uncomfortable, we will live with it. And third, after 33 years of focusing on finding the keys to a successful process and developing the techniques & tools that provide the information needed to get it right, we think it is our responsibility to our clients to run it with you, rather than handing you a race car and suggesting you take it for a spin. This is also why we price (hate to talk money, but this is important) our BD platform & service based on your success. Our fee goes up and down with your obligation intake, which means we are just as invested in your success as you are – and that’s the way it should be.